The Best Strategy To Use For Offshore Trust Services

Wiki Article

Indicators on Offshore Trust Services You Need To Know

Table of ContentsGetting My Offshore Trust Services To WorkExcitement About Offshore Trust ServicesThe Ultimate Guide To Offshore Trust ServicesThe Ultimate Guide To Offshore Trust ServicesOffshore Trust Services for DummiesThe Main Principles Of Offshore Trust Services Some Known Factual Statements About Offshore Trust Services Offshore Trust Services Fundamentals Explained

Private lenders, even larger private firms, are much more amendable to clear up collections against debtors with difficult as well as efficient possession defense strategies. There is no possession protection strategy that can discourage an extremely encouraged lender with endless money and persistence, however a well-designed offshore trust fund frequently gives the debtor a positive negotiation.Trustee business charge yearly costs in the variety of $1,000 to $5,000 each year plus hourly rates for extra solutions. Offshore depends on are except everyone. For many people residing in Florida, a domestic asset defense plan will be as reliable for a lot less money. For some people encountering hard lender problems, the offshore count on is the best alternative to secure a considerable quantity of assets.

Debtors may have a lot more success with an overseas trust strategy in state court than in a personal bankruptcy court. Judgment creditors in state court litigation might be daunted by offshore property defense trusts as well as may not look for collection of possessions in the hands of an offshore trustee. State courts do not have jurisdiction over overseas trustees, which suggests that state courts have actually limited solutions to get conformity with court orders.

The Definitive Guide to Offshore Trust Services

A bankruptcy borrower must surrender all their properties and also lawful passions in property anywhere held to the insolvency trustee. An U.S. insolvency court may oblige the insolvency borrower to do whatever is needed to transform over to the bankruptcy trustee all the debtor's properties throughout the globe, including the debtor's helpful passion in an offshore trust.Offshore asset defense counts on are less effective versus IRS collection, criminal restitution judgments, and also family support responsibilities. 4. Even if an U.S. court does not have territory over overseas trust fund possessions, the united state court still has individual territory over the trustmaker. The courts may try to urge a trustmaker to liquify a depend on or bring back trust properties.

The trustmaker needs to agree to quit legal rights and also control over their trust possessions for an offshore depend properly safeguard these possessions from united state judgments. 6. Selection of an expert and reliable trustee who will protect an overseas depend on is more crucial than picking an offshore trust fund jurisdiction.

All about Offshore Trust Services

Each of these nations has count on laws that are desirable for overseas possession security. There are refined legal distinctions among offshore depend on territories' legislations, however they have a lot more attributes in common.

An overseas trust is a standard trust fund that is created under the legislations of an overseas territory. Generally offshore trust funds are comparable in nature and also result to their onshore counterparts; they include a settlor transferring (or 'clearing up') possessions (the 'count on property') on the trustees to manage for the advantage of a person, class or persons (the 'beneficiaries') or, periodically, an abstract objective.

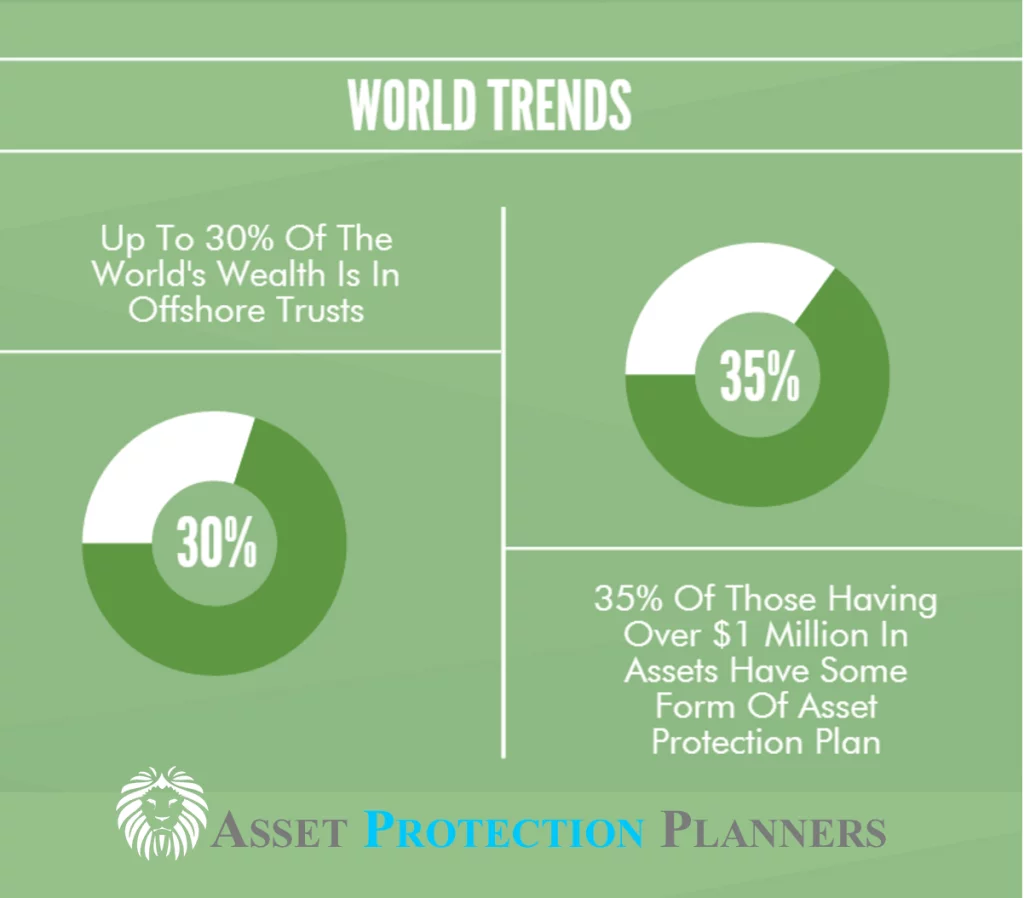

Liechtenstein, a civil territory which is sometimes taken into consideration to be offshore, has actually artificially imported the trust principle from common law territories by law. Authorities statistics on depends on are challenging to find by as in many offshore jurisdictions (as well as in many onshore territories), trust funds are not required to be registered, nonetheless, it is thought that the most common use of offshore trusts is as part of the tax obligation and monetary planning of rich individuals as well as their households.

Offshore Trust Services Can Be Fun For Anyone

In an Irreversible Offshore Trust fund might not be changed or liquidated by the settlor. A makes it possible for the trustee to choose the distribution of profits for different classes of recipients. In a Set trust, the distribution of earnings to the recipients is dealt with and also can not be transformed by trustee.Confidentiality as well as privacy: Although that an Extra resources offshore count on is officially registered in the government, the celebrations of the depend on, assets, as well as the problems of the depend on are not videotaped in the register. Tax-exempt status: Assets that are transferred to an overseas depend on (in a tax-exempt offshore area) are not exhausted either when moved to the trust, or when moved or rearranged to the recipients.

Facts About Offshore Trust Services Revealed

This has likewise been carried out in a variety of U.S. states. Count on basic go through the policy in which provides (briefly) that where count on residential property consists of the shares of a firm, then the trustees need to take a favorable function in the affairs on the company. The guideline has been criticised, yet stays part of depend on legislation in lots of typical law territories.Paradoxically, these specialist forms of depends on appear to occasionally be utilized in relation to their initial intended usages. Celebrity trusts seem to be used extra regularly by hedge funds creating shared funds as system trusts (where the fund managers wish to get rid of any kind of responsibility to participate in conferences of the business in whose safety and securities they spend) as well as panorama counts on are often made use of as a part of orphan frameworks in bond concerns where the trustees want to divorce themselves from supervising the issuing automobile.

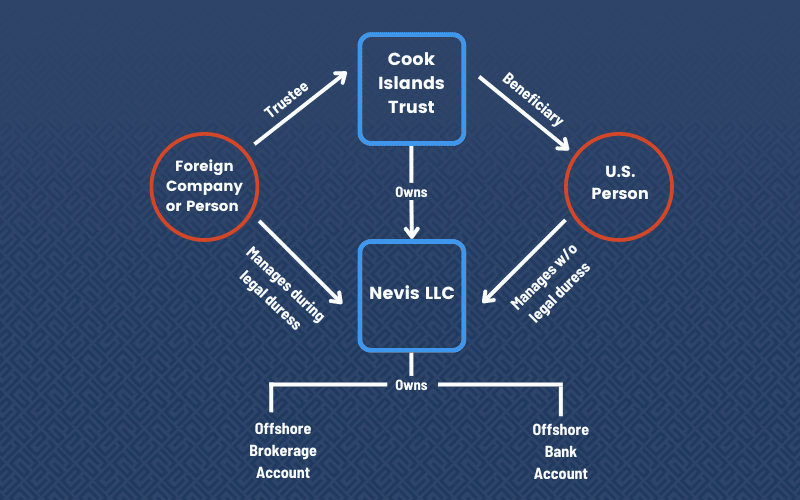

An offshore trust is a tool used for property security and also estate preparation that works by transferring properties right into the control you can check here of a legal entity based in another nation. Offshore trusts are unalterable, so depend on owners can not redeem ownership of moved properties.

Facts About Offshore Trust Services Uncovered

Being offshore adds a layer of defense as well as privacy along with the capability to handle taxes. As an example, since the depends on are not located in the United States, they do not have to find out here comply with united state laws or the judgments of U.S. courts. This makes it harder for financial institutions and also plaintiffs to go after claims against properties kept in offshore trusts.It can be tough for 3rd parties to figure out the possessions and also proprietors of offshore depends on, that makes them aid to privacy. In order to establish up an offshore depend on, the initial step is to choose a foreign country in which to locate the trusts. Some popular locations consist of Belize, the Cook Islands, Nevis as well as Luxembourg.

Not known Facts About Offshore Trust Services

Transfer the assets that are to be shielded right into the count on. Trust fund proprietors may initially create a restricted responsibility firm (LLC), transfer assets to the LLC and after that transfer the LLC to the trust fund. Offshore trust funds can be valuable for estate preparation and possession protection yet they have constraints.Earnings by possessions positioned in an overseas trust fund are cost-free of U.S. tax obligations. U.S. owners of offshore depends on also have to file reports with the Internal Earnings Solution.

The Ultimate Guide To Offshore Trust Services

Corruption can be a problem in some nations. In addition, it is necessary to choose a nation that is not likely to experience political discontent, regimen modification, financial upheaval or fast changes to tax obligation policies that can make an overseas trust fund much less valuable. Lastly, possession security trusts usually need to be developed prior to they are needed - offshore trust services.They likewise do not completely safeguard versus all insurance claims and might subject owners to threats of corruption and political instability in the host nations. Overseas trusts are handy estate planning as well as asset defense devices. Understanding the correct time to utilize a particular trust fund, and which depend on would certainly offer the most profit, can be complex.

An Offshore Count on is a popular Count on formed under the regulations of nil (or low) tax International Offshore Financial. A Depend on is an authorized game strategy (similar to an arrangement) whereby one individual (called the "Trustee") according to a succeeding individual (called the "Settlor") consents to acknowledge and also hold the home to help various individuals (called the "Beneficiaries").

Report this wiki page